One Graph Explains why Price Caps are a Bad Idea

Australia is not immune from the current global energy crisis caused by 3 main factors, the war in Ukraine and the sanctions posed on russia. Another factor is the post covid lockdown economic resurgence, in addition to the over reliance of renewables alongside the under utilisation of nuclear power by various governments across the world.

These factors have led to the price of natural gas rising by over 250% since 2020, with coal rising by approx. 300% in the same time period. This has seen a sizable increase in government revenue as Australia is a major exporter of coal and gas to the international market. However, this has also led to businesses and households, mainly across the eastern seaboard that consist of the following states, South Australia, Victoria, Tasmania, New South Wales and Queensland, to have power bills that have doubled. The manufacturing industry relies on relatively low power prices to remain competitive to the international market. But with power prices doubling for some businesses, these businesses will have two choices to consider. One, raise prices that could incentivise customers to go overseas and two, to shut the doors as costs outrun revenue.

Either way, both options will eventually lead to job losses and valuable businesses to national security being lost, meaning that Australia is further exposed to international factors. The solutions talked about in the media from various stakeholders to solve the energy crisis have ranged from, pulling the gas trigger where a reservation policy will be in effect, to introducing a windfall tax on oil and gas profits and the other major policy is to set a price cap on power prices for consumers. All the solutions mentioned above do not address the causes of the problem, only the symptoms. It is the third option that is the most worrisome, price caps. This is where prices of a good cannot exceed a certain price. For example, a pizza as per government law, can't be above the price of 8 dollars and if the cost of a pizza to produce is 9 dollars, that means that the business is losing money which unnecessarily increases the chances of the business shutting the doors. The Australian Government is looking at setting a price cap of gas in the wholesale market at $12 a gigajoule as hinted at in an article published by the ABC on the 29th of November. $12 a gigajoule is well below current averaged market price of apprx. $23 a gigajoule.

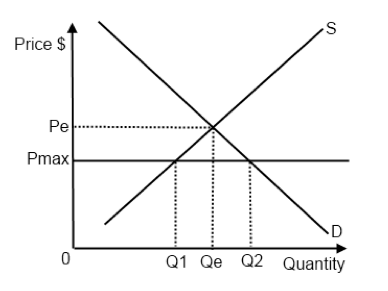

This is the worst possible option that the government can take for the long term viability of the energy market for Australia. insert Graph As shown in the graph above, with the price below the equilibrium, where price and quantity meet, there will be a shortage of power in the market. There are two reasons for this, the first is that as prices decrease, consumers use more of the product as it becomes more affordable. However, when there is already limited supply in the market this makes the situation worse as there is more demand for already a relatively scarce product in the market. This means that there is more pressure on the producers to provide power at below cost levels. The second reason why there is a shortage is due to producers closing down as they can no longer afford the cost of running a business within this market environment. As seen in the UK, due to the market price caps set up by the market operator, since early 2021, 31 energy companies have ceased trading as they can only charge way below costs of providing power to consumers. In total, approx 3.5 gigawatts of capacity has had to close over that period due to price caps, which means that there is more pressure on the suppliers who are in the market.

What is the solution to this problem? The answer is to deregulate the energy sector including legalising nuclear power with minimal regulations to save time and money whilst having public support for it as well as removing subsidies for energy projects. The problem with price caps is that they don't address the cause of the problem. They only address the symptom of the cause. With a freedom based approach to this problem, Australia will never again be in this situation that it now finds itself in as it becomes stronger within the energy market. The reason why this will happen is that companies from within Australia and outside will want to invest into our energy market with all forms of power, with nuclear Small Modular Reactor technology leading the change within the market. What people need to understand is that energy creates wealth and wealth creates energy. With a freer market environment, Australia can once again be a self-sustaining energy producer with a very large export base.